Can Brands Hurdle Challenges to Meet Their 2025 Sustainability Targets?

Examining the extensive partnerships around mechanical and chemical recycling and how Extended Producer Responsibility legislation is faring.

Image courtesy of Getty Images / Malekas85

Consumer Packaged Goods (CPGs) companies' expectations of a supply of more post-consumer recycled (PCR) content didn’t materialize in 2023. Consumers are demanding more recycling content in their packaging, and CPGs have targeted 25% of their packaging to be PCR by 2025. Many PCR targets were set close to 2020 or during the pandemic.

So, as we get closer to 2025, is the PCR supply chain ready to meet brands’ ambitious sustainability targets?

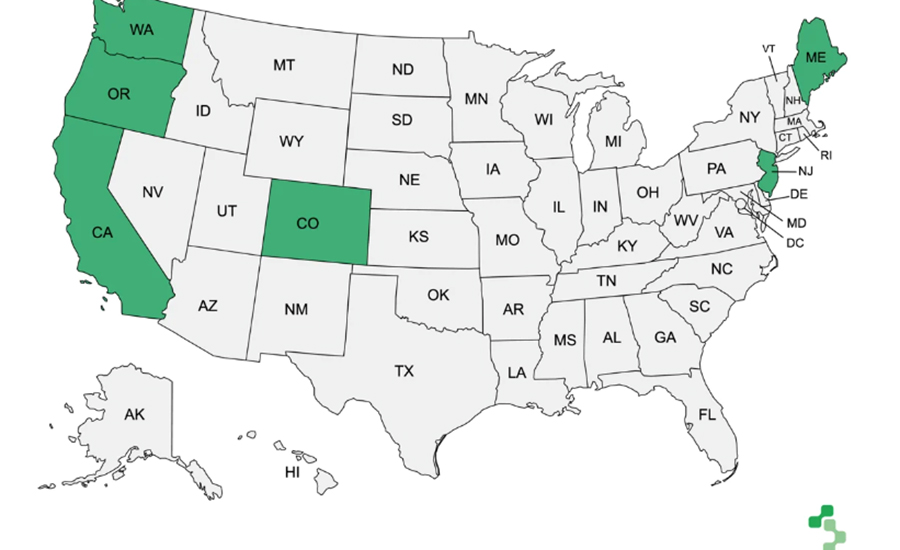

At this point, most industry analysts are leaning toward “no,” but sizable progress has been made by state-led Extended Producer Responsibility (EPR) packaging legislation and increased industry stakeholder collaboration. While EPR laws for e-waste and batteries have been on the books for years, there are now six states with EPR packaging laws, and it’s all happened since the pandemic. EPR packaging laws apply to producers: manufacturers, brand owners or licensees, importers, distributors, and converters.

The states with EPR legislation aren’t small, including California, Colorado, Oregon and Washington, to name a few. PCR content is rising, and coordinated strategies and investments are brisk among industry, nonprofits, material recycling facilities and financial institutions, like Closed Loop Partners.

However, this move away from non-virgin packaging material will take time. Recently, there has been increased investment in mechanical recycling facilities with the hope of greater recycling rates. While chemical recycling is making inroads, EPR legislation is recognized as a critical instrument in increasing recycling rates.

“Investment can and should come from the EPR programs being implemented in the four states that have passed laws,” says Alison Keane, president and CEO of the Flexible Packaging Association (FPA) in a recent FOOD ENGINEERING article. The FPA has also challenged “poorly written EPR legislation” in other states. In a December 2023 letter to its members, FPA said the challenges against other states had to do with its untested approach. The FPA cited that “first-step state assessments and studies should be implemented before full-blown ERP implementation.”

A 2023 EPR study by The Recycling Partnership (TRP), a non-governmental organization, found that “seven paper and packaging recycling programs showed that EPR policy drove the collection and recycling of target materials to over 75% in British Columbia, Belgium, Spain, South Korea and the Netherlands, with Portugal and Quebec at over 60%. Across all materials, U.S. state programs performed far lower without EPR programs in place.”

“Lack of sustainable funding is one of the greatest challenges for U.S. residential recycling systems, so EPR provides a huge opportunity to unlock the environmental and economic benefits of recycling,” says Keefe Harrison, CEO of TRP.

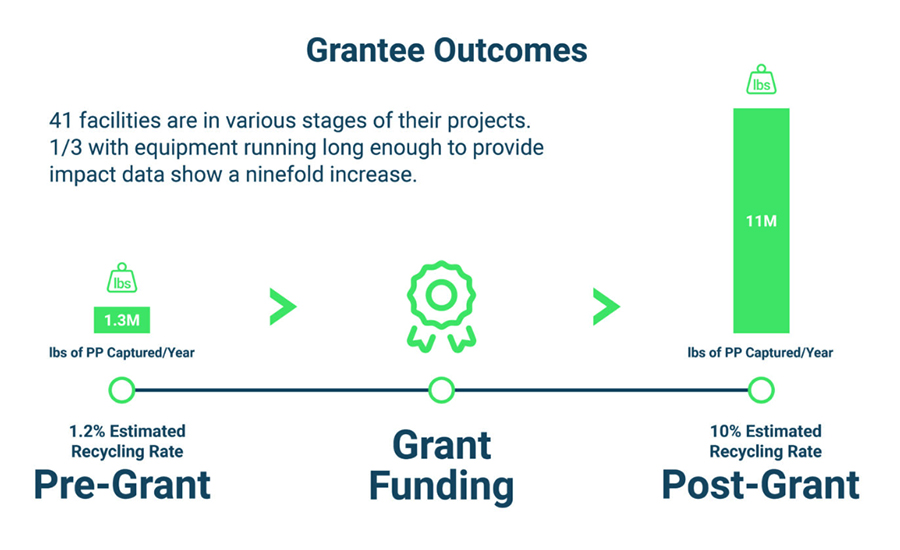

Moreover, TRP is working on expanding polypropylene (PP) recycling for community pick-up programs and material recovery facilities (MRFs). TRP has provided $10.3 million in grants during the last four years to support new and improved PP sortation for 41 MRFs across the U.S. For years, polypropylene had been excluded from single-stream recycling facilities. However, with these grants, recycling rates are increasing.

Of the 41 MRF recipients for the $10.3 million in grants, one-third of the 41 MRF recipients have provided PP recycled data rates: Before the funding grants, facilities collectively captured 1.3 million pounds of PP annually. However, post-funding grants, they have captured 11 million pounds of polypropylene annually—a ninefold increase.

TRP isn’t slowing down, either. The organization provided a PP grant for a new optical sorter at the Lakeshore Recycling Systems’ MRF in Chicago, called the Exchange. The Exchange opened in August 2023 and will be able to operate at 25 tons per hour, which could be expanded to 35 tons/hr. in the future, according to reports. The Closed Loop Fund, Macquarie Asset Management, TRP and others invested more than $50 million at this facility. Besides a new optical sorter, Lakeshore’s equipment at the new facility includes a swing arm feeder drum breaking up single-stream materials, auger screens and six sorters from CP Manufacturing.

Besides PP recycling, The Recycling Partnership launched a free resource in October 2023 called the Recycling Program Solutions Hub. This new tool allows local recycling staff to connect, optimize and expand their recycling programs by providing an interactive U.S. recycling map.

“The Hub will give them ready-to-use solutions as well as a two-way data exchange with The Recycling Partnership’s National Recycling Database, thereby improving local access information while also making advancements that will impact the broader recycling system,” says Louise Bruce, managing director of the Center for Sustainable Behavior & Impact at The Recycling Partnership.

The resource hub includes a map that displays local program attributes and processing capabilities, and the ability for a recycling staff to view customized program recommendations based on their actual local program data. In other words, system modeling for local recycling programs to make better decisions.

Increased PCR Content from Chemical Recycling

While industry collaboration and EPR is making inroads, brands need more EPR legislation and market certainty. In a recent industry article, Charlie Schwarze, senior director of sustainability, at Keurig Dr Pepper said, “we haven’t made decisions on post-2025 goals for packaging at this point.” Some of the company’s other goals around sustainability are pegged to 2030. But policy momentum will likely drive a future set of packaging goals.

Other CPGs, like PepsiCo, are investing more resources in recycled polyethylene terephthalate (rPET) to help its sustainability goals for 2025. PepsiCo reported working to “increase rPET across several beverage brands, including offering Pepsi, Mountain Dew and Aquafina products in bottles made from 100% rPET in multiple U.S. geographies in 2023.” PepsiCo estimates that shifting to bottles made from 100% rPET reduces GHG emissions by approximately 30% per bottle and reiterates its goal of completely phasing out bottles made from virgin plastics.

While most brands will probably miss their lofty 2025 PCR packaging targets, chemical recycling facilities could help fill the gaps going forward. Eastman Chemical in Kingsport, Tenn., announced plans to build its first U.S.-based chemical recycling facility in early 2021.

“A lot of the applications we're targeting with this recycled content—especially in the PET—are applications where mechanical recycling is not able to meet the specifications in performance,” said Mark Costa, CEO of Eastman Chemical, in a 2023 earnings call. “Our product is identical to virgin material made from fossil fuels and mechanical (recycling) is not. It's got integrity and color issues. So, we are really targeting those applications where mechanical is not a choice.”

According to industry reports, the Eastman Chemical recycling plant in Tennessee has preprocessed 25,000 metric tons of scrap polyester in late 2023 and is close to full operation. The company is also building a second chemical recycling plant in France that it expects to be operational by mid-2024.

Strong Consumer Preferences

Oddly, sustainability preferences from consumers became more definitive during the pandemic and have kept the pressure on CPGs. The trend hasn’t stopped. Due to many drivers and social media influencers, consumers are hearing more sustainability claims, producing interesting observations. A recent example is the 2023 Hartman Group survey with more than 2,200 respondents. One finding from this survey revealed that “Gen Z and Millennials' perception of higher-quality ingredients and sustainable practices, like B Corp or Fair Trade Practices, translated into better-tasting drinks.”

With these consumer behaviors in place, industry partnerships are strengthening to address this sustainability wave. In 2022, Walmart launched its Circular Connector, a resource on design, recycling, definitions and sustainability trends for brands. The platform allows brand sourcing teams to find sustainable packaging solutions via packaging suppliers as companies submit products and are screened against Walmart’s sustainable packaging goals. If they align with Walmart's goals, the suppliers’ products will be published for public download on walmartsustainabilityhub.com.

One company that recently qualified was Amcor. Amcor’s recycle-ready AmSky and AmPrima packaging solutions became available in October 2023 on Walmart’s Circular Connector Platform. AmsKy is a recycle-ready blister pack that doesn’t include aluminum and polyvinyl chloride (PVC), and uses high-density polyethylene (HDPE).

Increased Recycling Rates in EPR States

With industry-led PCR recycling initiatives starting to ramp, hitting these packaging goals in 2025 will take a lot of work. According to Keurig Dr Pepper’s Schwarze, the company’s work in 2024 on sustainability targets “will be a marathon sprint.”

One trend that shouldn’t waver is more mechanical recycling facility construction and capital in EPR states. In California, the Caglia family’s Cedar Avenue Recycling and Transfer Station (CARTS) facility is targeting polypropylene (PP) for increased recycling rates and profitability. With the current ERP legislation in place, the facility recycles more than 70% of its collection volume that is then repurposed into raw material feedstock for new packaging.

CARTS sees PP as the next big trend in recycling and recently invested in three robotic arms to sort out the multiple types of collected material. AMP out of Louisville, Colo., provides robotics to CARTS, which includes a single-arm robot for PP—via a TRP grant—and a tandem robotic system for picking up HDPE natural, HDPE color, PET and film. The company also has a robot dedicated to its aluminum can line for quality control (QC).

PP has historically been difficult to recover due to an array of form factors, but it is now emerging as one of the most significant revenue opportunities for MRFs, due to consumer demand, producer commitments and government policy, according to CARTS.

“My family’s been around for so long because we like to stay on top of technology,” says Rich Caglia, owner of Caglia Environmental. Caglia’s recent equipment investment includes two new disc screens, four optical sorters, an auger screen and an eddy current, which allowed the facility to process between 25 and 35 tons per hour—up from 10 to 12 tons per hour.

AMP’s robot and vision systems also include a neural network that can recognize 50 billion objects on an annual basis and more than 4.5 million discrete PP materials daily, according to the robotics supplier. The MRF is now producing cleaner, more valuable PP bales instead of a mixed bale of #3-#7 plastics. “The robot is keeping the material out of the landfill, and polypropylene is now a marketable product for us,” says Keith Hester, Caglia Environmental general manager.

Inflection Point for Recycling Rates

2024 could be a monumental year for increased recycling rates in the U.S., with Eastman Chemical ramping up its $250 million recycling plant in 2023 and recent news from Envision Plastics on its EcoPrime capacity expansion. This newly expanded North Carolina plant from Envision will increase the company’s capacity for “fit-for-food contact PCR recycled resin by 50% for current and new customers.” Resin types include polyethylene PCR and Polypropylene PCR. Ecoprime uses curbside-collected, recycled HDPE PCR and has received U.S. Food and Drug Administration and Health Canada approvals. The product can be used for a wide range of food applications, including rigid bottles, caps and closures, and blown film for various industries such as dairy, water, cosmetics and nutraceuticals.

Moreover, many other major petrochemical companies are moving quickly to chemical recycling. In late 2022, BASF and StePac Ltd. announced a chemical recycling agreement, and New Hope Energy and TotalEnergies agreed on a new chemical recycling partnership. New Hope Energy will gather mixed plastic waste feedstock from MRFs and convert it to feedstock. The plant is expected to be online in 2025.

At a Resource Recycling conference in 2022, Paula Luu, a senior project director with Closed Loop Partners, commented on mechanical and chemical recycling. “Mechanical recycling has a smaller environmental footprint, but the diversity of plastics today requires a diversity of solutions,” Luu said. “Molecular (chemical) recycling is just one slice of that pie and it’s important for the industry and world to first define what waste-free success looks like.”